Today’s article talks about the new kid on the block in the Indian cement industry which has filed its Draft Red Herring Prospectus (DRHP) for Rs4,000 crores. Lets look at some of the facts of the Indian Cement Industry and JSW Cement.

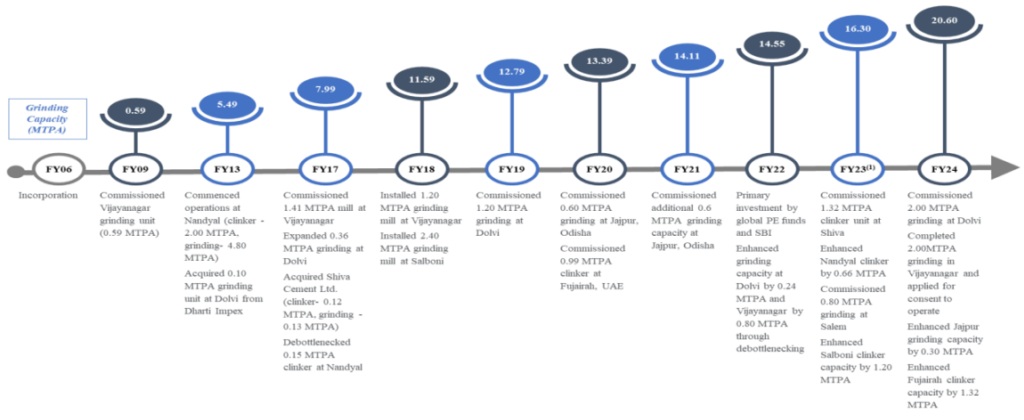

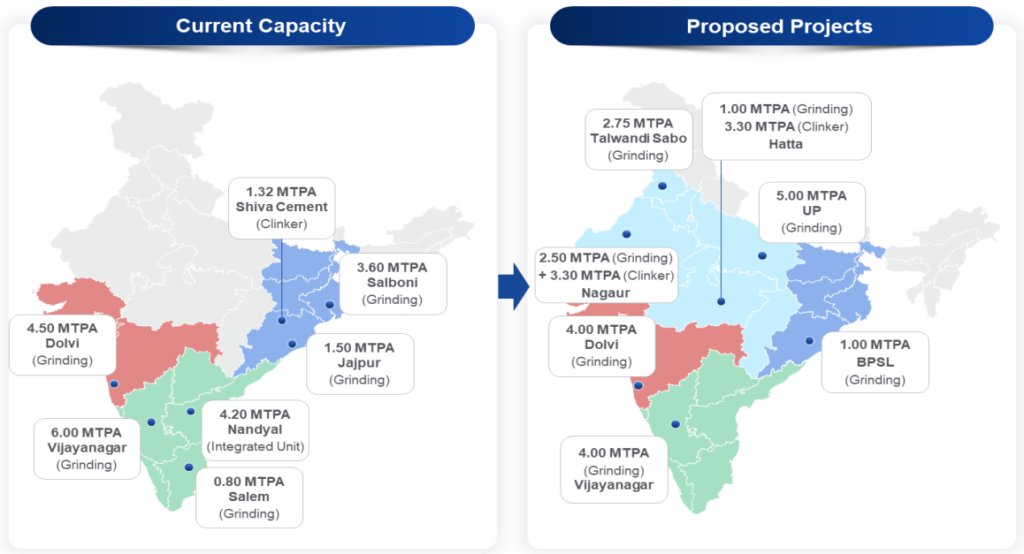

JSW Cement started its operations in 2009 in the southern region of India through its single grinding unit in Vijayanagar, Karnataka. Since then, they have expanded its presence across the southern, western and eastern regions of India and UAE. As of Mar’24, they operate seven plants in India, which comprise one integrated unit, one clinker unit and five grinding units across the states of Andhra Pradesh (Nandyal plant), Karnataka (Vijayanagar plant), Tamil Nadu (Salem plant), Maharashtra (Dolvi plant), West Bengal (Salboni plant), Odisha (Jajpur plant and majority owned Shiva Cement Limited clinker unit). JSW Cement FZC also operates one clinker unit in the UAE that supplies clinker to the Dolvi grinding unit in western India and to third-party customers.

As on FY24, JSW Cement had a installed grinding capacity of 20.6 MTPA of which 11 MTPA in the South, 4.5 MTPA in the West and 5.1 MTPA in the East region of India. The company also has a installed clinker capacity of 6.44 MTPA. JSW sold total of 12.5 mt volumes in FY24 totaling to a revenue of Rs6,028 cr translating to an ~blended realization of Rs4,822/tn.

One of the fastest growing cement company in India

JSW cement is planning to expanding its presence across India by entering newer geographies and adding to its capacities through greenfield as well as brownfield expansion. These capacity additions are expected to increase the Installed Grinding Capacity by 98.3% from 20.6 MTPA to 40.85 MTPA and Installed Clinker Capacity by 102.5% from 6.44 MTPA to 13.04 MTPA.

Coming to the Cement Industry, it grew at a healthy ~6% CAGR over FY19-24. Pan-India cement demand grew 8% in FY22 and accelerated further by ~12% in FY23, supported by strong demand for rural housing and infrastructure. A pre-election boost and healthy traction from infrastructure segment led to further 11% growth in FY24. Over the next five years, i.e., FY25-29, CRISIL MI&A Research expects cement demand to clock a healthy 6.5-7.5% CAGR driven by infrastructure investments and healthy momentum from housing segment. Initiatives undertaken by the Government of India, such as the Bharatmala Pariyojna, Sagar Mala, the Pradhan Mantri Awaas Yojana – Gramin, Atmanirbhar Bharat Abhiyan, Product Linked Incentive Scheme, Swachh Bharat Mission, UDAN for airports and metro projects along with the thrust on infrastructure will drive demand growth in the medium term for the cement industry in India.

Leave a Reply